October 19, 2025

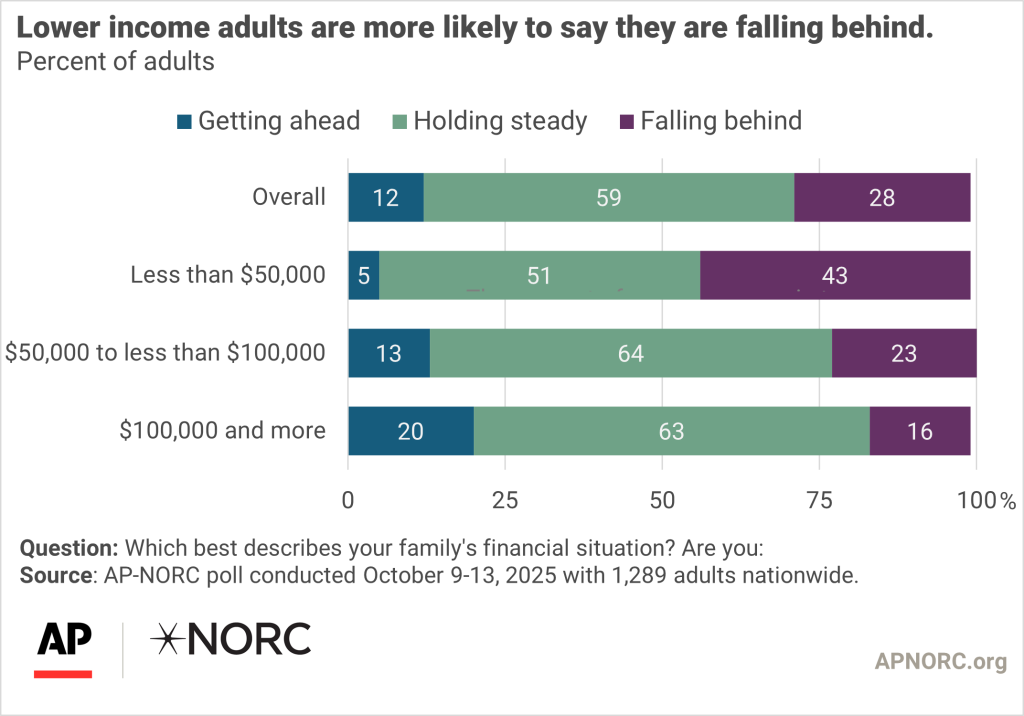

Fifty-nine percent of Americans say their family’s financial situation is holding steady. Nearly 3 in 10 feel they are falling behind. Only 1 in 10 say they are getting ahead.

Republicans are more likely than Democrats to say they are getting ahead (21% vs. 7%). Lower-income adults, making less than $50,000 per year, are the most likely to feel they are falling behind financially. Adults under 30 are more likely than those age 60 and older to say their family’s financial situation is falling behind (37% vs. 18%).

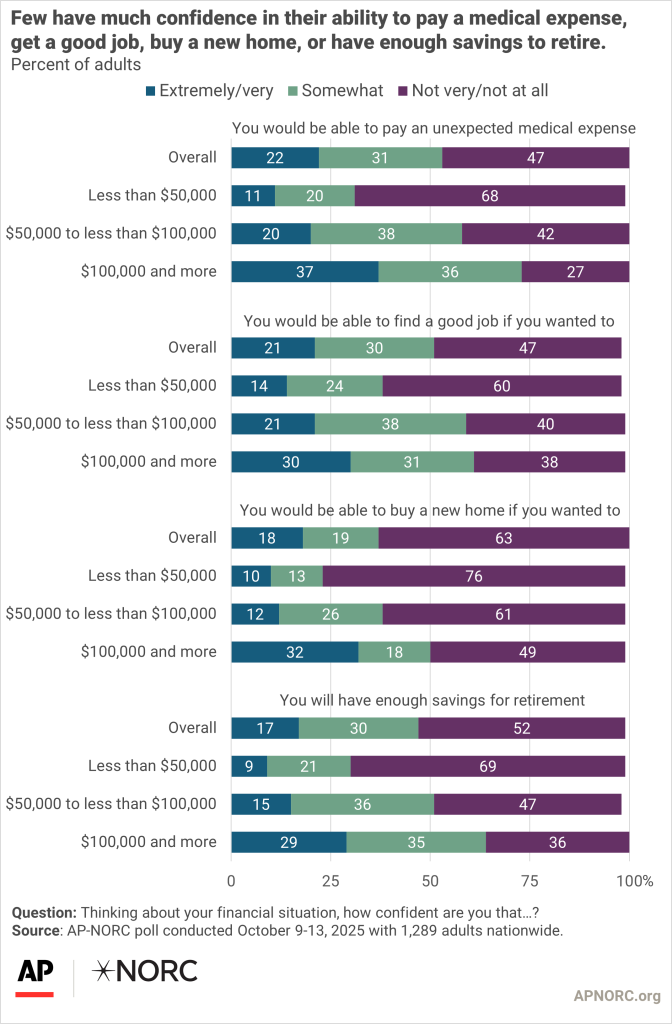

In line with prior AP-NORC polls, few adults are extremely or very confident they would be able to find a good job, pay an unexpected medical expense, have enough savings for retirement, or buy a new home.

Confidence in a person’s financial situation largely depends on income, with those in households earning $100,000 or more generally feeling more confident than those earning $50,000 or less.

Republicans tend to feel more confident than Democrats in their ability to pay an unexpected medical expense (32% vs. 16%), find a good job (30% vs. 15%), buy a new home (24% vs. 14%), or save enough for retirement (22% vs. 14%).

Adults age 60 and older are more confident than adults under 30 in their ability to buy a home (21% vs. 7%). Employed adults are more confident in their ability to find a good job if they wanted compared with those who are unemployed (27% vs. 12%).

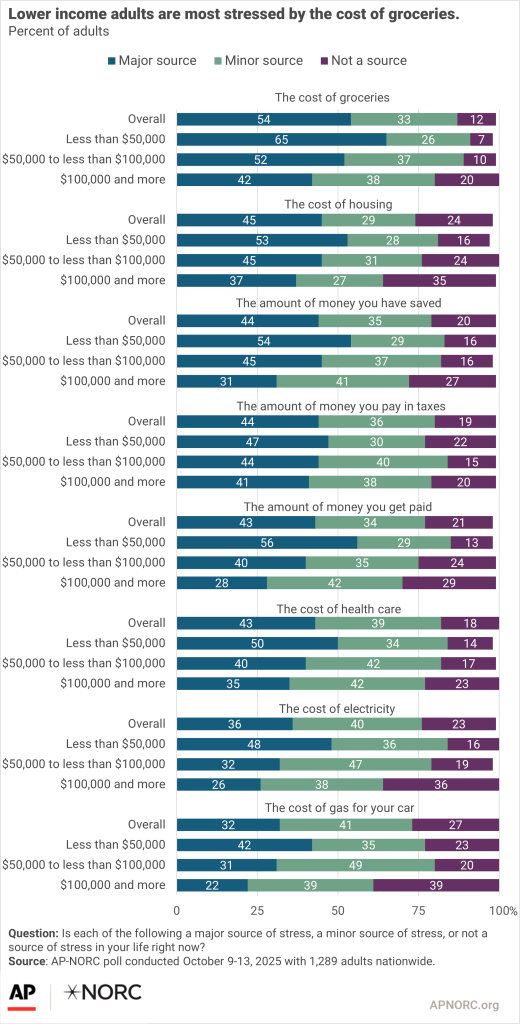

About half of adults say the cost of groceries is a major source of stress. Another 4 in 10 feel the same about the amount of money they have saved, their income, or pay in taxes, as well as the cost of housing, health care and electricity. Around a third are very stressed about the cost of filling up their car with gas. For each grid item asked, few say they are not a source of stress.

Three in four adults (78%) say at least one of the items is a major source of stress. Close to all (97%) are at least slightly stressed about one.

Aside from money paid in taxes, adults in households making $100,000 or more tend to be less stressed than those making less than $50,000.

Women are more likely than men to worry about the cost of groceries (63% vs. 44%), health care (49% vs. 36%), and electricity (41% vs. 31%).

Compared with those 60 or older, adults under 30 are more inclined to be stressed about the cost of housing (64% vs. 31%) and their salaries (53% vs. 32%).

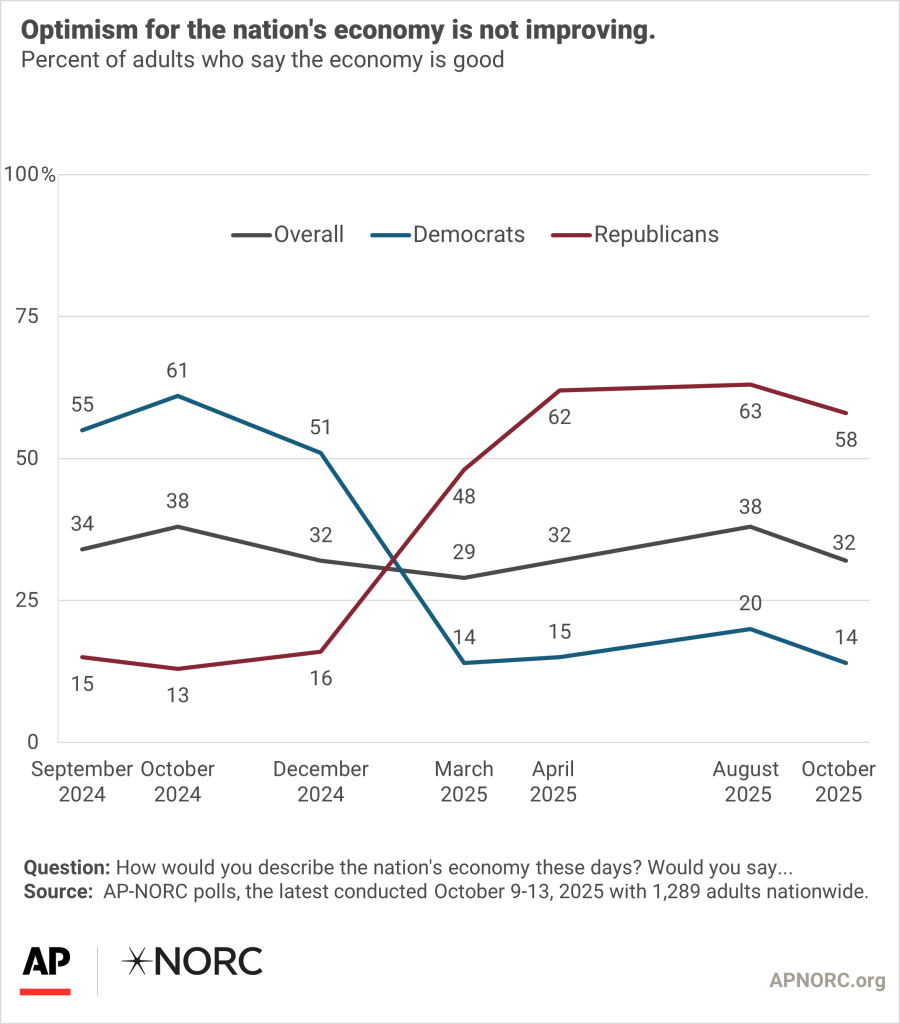

Most adults continue to view the state of the nation’s economy negatively, with 68% saying it is poor or very poor. Democrats and independents are more likely than Republicans to feel the economy is poor (86% and 83% vs. 42%). Republicans became more positive about the economy after Donald Trump began his second term, while Democrats became more negative.

Only 17% of adults under the age of 30 are optimistic about the economy compared with 41% of adults 60 or older. Women are more pessimistic about the nation’s economy than men (75% vs. 61%).

The nationwide poll was conducted October 9-13, 2025 using the AmeriSpeak® Panel, the probability-based panel of NORC at the University of Chicago. Online and telephone interviews using landlines and cell phones were conducted with 1,289 adults. The overall margin of sampling error is +/- 3.8 percentage points. Hispanic adults were sampled at a higher rate than their proportion of the population for reasons of analysis. The overall margin of sampling error for the 378 interviews completed with Hispanic respondents is +/- 6.9 percentage points.

- Suggested Citation: AP-NORC Center for Public Affairs Research. “Most say their financial situation is holding steady, but it’s tenuous.” (October 2025). https://apnorc.org/projects/most-say-their-financial-situation-is-holding-steady-but-its-tenuous/