By Ricardo Alonso-Zaldivar | The Associated Press

April 27, 2022

WASHINGTON (AP) — The older you are, the less you fret about aging in your own home or community.

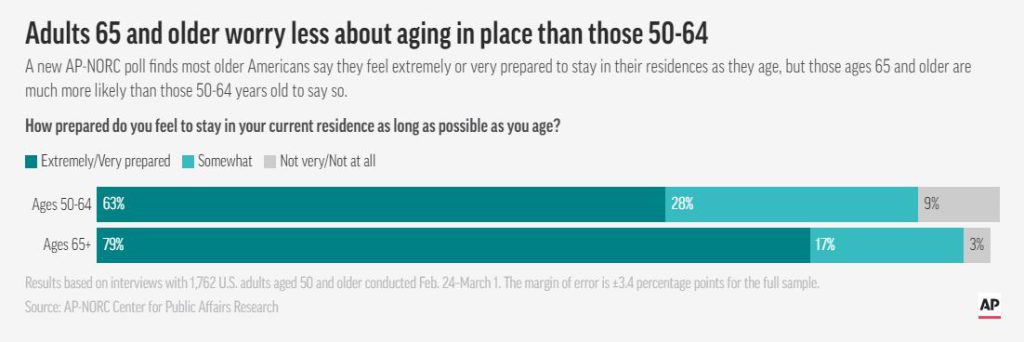

That’s a key insight from a new Associated Press-NORC Center for Public Affairs Research poll, which found that U.S. adults ages 65 or older feel much better prepared to “age in place” than those 50-64, who are mostly still in the final stretches of their working years.

The poll also documented greater insecurity around aging in place for older Black and Latino Americans, the likely result of a deep-rooted wealth gap that markedly favors white people.

Aging in one’s own home, or with family or a close friend, is a widely held aspiration, with 88% of adults 50 and older saying it’s their goal in an earlier AP-NORC poll.

The outlook among those 65 or older is upbeat, with nearly 8 in 10 saying they’re extremely or very prepared to stay in their current home as long as possible.

But doubts creep in for those ages 50-64. Among that group, the majority who rate themselves as extremely or very prepared shrinks to about 6 in 10, according to the poll.

This relatively younger group is especially likely to say their financial situation is the main reason they don’t feel very prepared to age in place. And they’re also more likely to feel anxious about being able to stay in their communities, get care from medical providers and receive backup from family members or close friends, the poll found.

Part of it may be due to fear of the unknown among people who’ve relied on a paycheck all their lives.

“When you’ve never done it before, and you are only going to do it once, you’re sort of flying by the seat of your pants,” said Leigh Gerstenberger, in his late 60s and retired from a career in financial services. “I spent a lot of time talking to people ahead of me in the journey,” says the Pittsburgh-area resident.

Also, people approaching their 60s may question if Social Security and Medicare will truly be there for them. Stacy Wiggins, an addiction medicine nurse who lives near Detroit, figures she’ll probably work at least another 10 years into her late 60s — and maybe part-time after that. Older friends are already collecting Social Security.

“In my group, you wonder if it’s going to be available,” Wiggins said of government programs that support older people. “Maybe it’s not. You will find people who are less apt to have a traditional pension. Those are things that leave you with a lot of trepidation toward the future.”

Some people now in their 50s and early 60s may still be dealing with the overhang of the 2007-09 recession, when unemployment peaked at 10% and foreclosures soared, said Sarah Szanton, dean of the Johns Hopkins University nursing school. For an aging society, the U.S. does relatively little to prepare older adults to navigate the transition to retirement, she observed.

“As Americans, we’ve always idolized youth and we’re notoriously underprepared for thinking about aging,” Szanton said. “It often comes as a surprise to people.” Her involvement with aging-in-place issues started early in her career, when she made house calls to older people.

In the poll, people 50 and older reported that their communities do an uneven job of meeting basic needs. While access to health care, healthy food and high-speed internet were generally rated highly, only 36% said their community does a good job providing affordable housing. Just 44% were satisfied with access to transportation and to services that support older people in their homes.

Kym Harrelson-Pattishall is hoping that as more people retire to her coastal North Carolina community, health care facilities and other services will follow. As it stands now, a major medical issue can involve a car trip of up to an hour to the hospital.

A real estate agent in her early 50s, Pattishall shares the goal of aging at home, but her confidence level is not very high. “I think it would just eat away what savings I have,” she said.

It’s all about adjusting, says another small-town resident, about 20 years older than Pattishall. Shirley Hayden lives in Texas, near the Louisiana border and on the track of hurricanes from the Gulf of Mexico. She says she has no investments and only modest savings, but she rates herself as very prepared to continue aging in place.

“You have to learn to live within your means,” Hayden said. “I don’t charge things I can’t afford to pay for.

“My biggest thing I have to work around as far as expenses is insurance,” she added. “I don’t really need any new clothes. In Texas, you live in jeans and T-shirts and they don’t go out of style. Yeah, your shoes wear out, but how often do you buy a pair of shoes?”

Not so easy to work around is the well-documented racial wealth gap that constrains older Black people in particular. A Federal Reserve report notes that on average Black and Latino households own 15% to 20% as much net wealth as white households.

In the poll, 67% of Black Americans and 59% of Latino Americans ages 50 and older said they felt extremely or very prepared to stay in their homes as long as possible, compared with the 73% share of white Americans saying they feel confident.

Wiggins, the Detroit area nurse, is Black and says it’s a pattern she’s familiar with. “Part of it is generational wealth,” she said. “I have friends who are white, whose dad died and left them settled. I have friends who are Black whose parents died, and they left enough to bury them, but nothing substantial.”