A decade after the Great Recession officially ended, Americans’ satisfaction with their personal financial situations has rebounded to pre-recession levels, according to a collaborative analysis of the 2018 General Social Survey (GSS) by The Associated Press-NORC Center for Public Affairs Research and GSS staff. More adults again say that they are satisfied with their financial situation than unsatisfied, and more say their financial situation has gotten better than say it has stayed the same or has gotten worse. But not all Americans have fully recovered, and older adults, African Americans, those without college degrees, and women are all more likely than their counterparts to have negative views of their finances.

In the wake of the Great Recession came dramatic declines in how the public evaluated their personal finances, job prospects, and outlook for the future. Since then, the economic outlook has improved, but confidence in some aspects of the job market still falls below pre-recession levels. In addition, several characteristics of work life suggest the recession is still impacting the quality of people’s work lives.

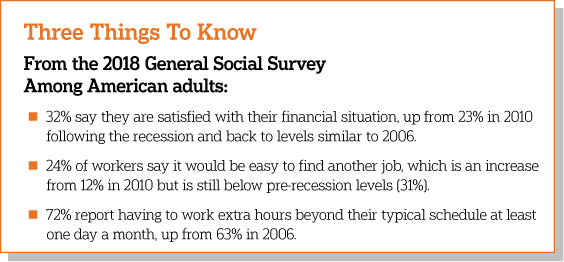

In terms of the recovery, 32% say they are satisfied with their personal financial situation, up from 23% in 2010 and back to similar, pre-recession levels in 2006. Likewise, 43% of Americans say their finances have gotten better in the last few years, up from 25% in 2010 and back to pre-recession levels.

Other indicators have yet to rebound. While more workers say it would be easy for them to find another job in 2018 (24%) than said the same in 2010 (12%), this remains below where it was in 2006 (31%). Sixty-one percent say they have a better standard of living than their parents, virtually unchanged since 2010 and down from 66% before the recession.

Younger and older Americans have responded differently to the recession. Younger Americans are more satisfied with their financial situation and express more optimism about the future, but they also have struggled more with unemployment and express concerns about job security.

Whites’ attitudes about their financial situation have rebounded from the recession more so than African Americans. The reported financial satisfaction among whites declined from 34% to 27% during the recession, but has since rebounded to 36%. In contrast, 22% of blacks say they are satisfied in 2018, which is consistent with satisfaction levels before and during the recession. Whites and blacks were similarly likely to express frustration with their compensation and ability to meet their monthly expenses during the recession, but blacks are now more likely than whites to say they earn less than they deserve (47% vs. 36%) and are less likely to say their income is enough to cover their monthly bills (39% vs. 52%). Hispanics generally express low levels of financial satisfaction with their incomes and financial situations, but their views are not significantly different from either blacks or whites when controlling for other demographics factors.

College graduates weathered the recession better than those without a degree. College graduates saw little change in their level of satisfaction with their finances during the recession. But those without a degree bottomed out in 2010, with 63% saying they were at least more or less satisfied, though they have since recovered to pre-recession levels (74%). Additionally, 64% of college graduates identify as middle or upper class compared to 37% of non-college graduates.

The financial outlooks of men have rebounded more since the recession than those of women. Women are less satisfied than men with their finances, incomes, and earnings, and they tend to say that they do not earn enough to meet monthly expenses. Women, however, continue to be more optimistic that their children’s standard of living will be better than their own (61% vs. 53%).