December 12, 2025

The majority of the public continues to feel they are paying higher prices than usual for groceries, electricity, and holiday gifts. About half are changing their shopping behaviors – seeking out deals and cutting back on large or non-essential purchases.

Comparable to polling from the height of inflation in December 2022, much of the public is reporting higher prices for groceries, electricity, and holiday gifts. Far fewer today are experiencing inflated gas prices though, with half reporting that gas is more expensive than usual compared with 83% in 2022.

As the holiday season approaches, many people are becoming more mindful of their spending habits and making adjustments. Half report searching for the lowest prices and delaying large purchases more than usual in recent months.

About half, 48%, are shopping for non-essential items less than usual and just 13% are shopping more often for those items.

Additionally, 4 in 10 are drawing from savings more than usual, while nearly half say they are withdrawing from saving about the same as they typically do.

More Americans are tightening their belts this holiday season than compared with the last time this question was asked in December 2021 as inflation was starting to climb. And nearly half are buying non-essentials less than usual, compared with about a third 2021.

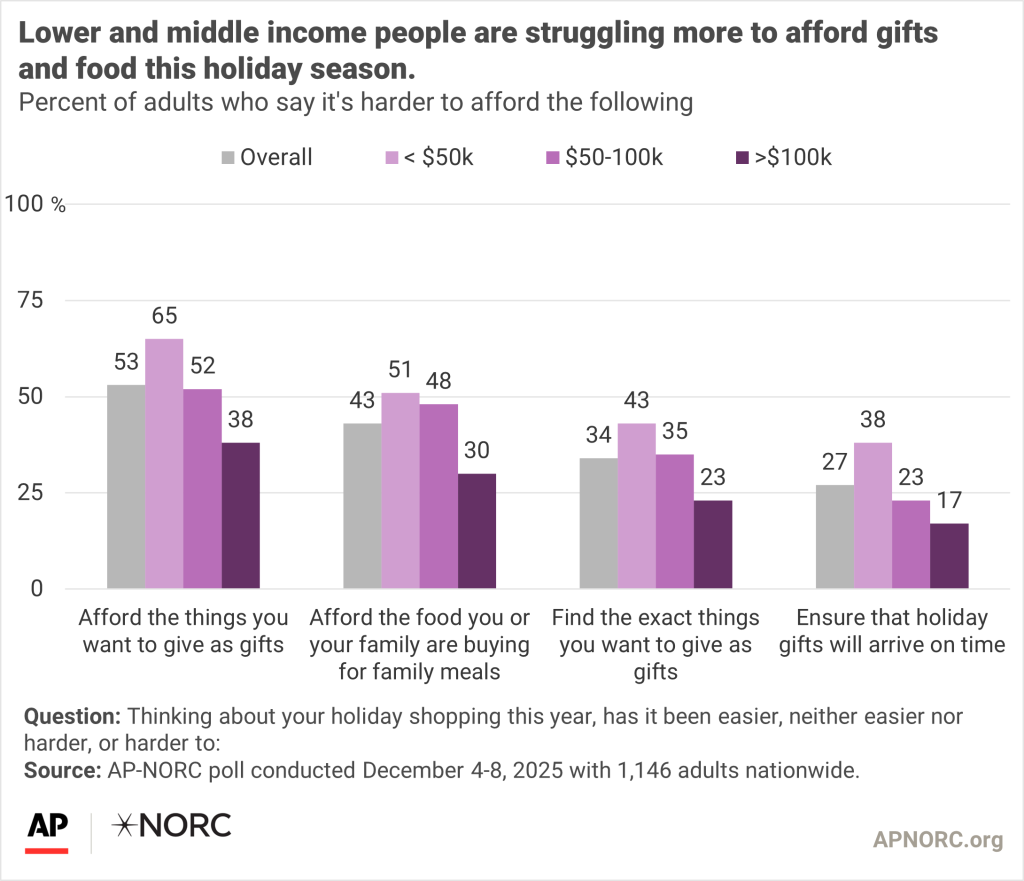

Lower income adults (those who make less than $50,000 per year) were more likely than more affluent people to defer large purchases more than usual and shop for nonessentials less than usual.

Supply chain problems are less of a concern than increasing prices. Most adults (56%) say it has gotten neither easier nor harder to find the exact things they want to give as holiday gifts.

However, more people are finding it harder to afford the things they want to give as gifts or to afford food for holiday meals. This is especially true for lower and middle-income adults.

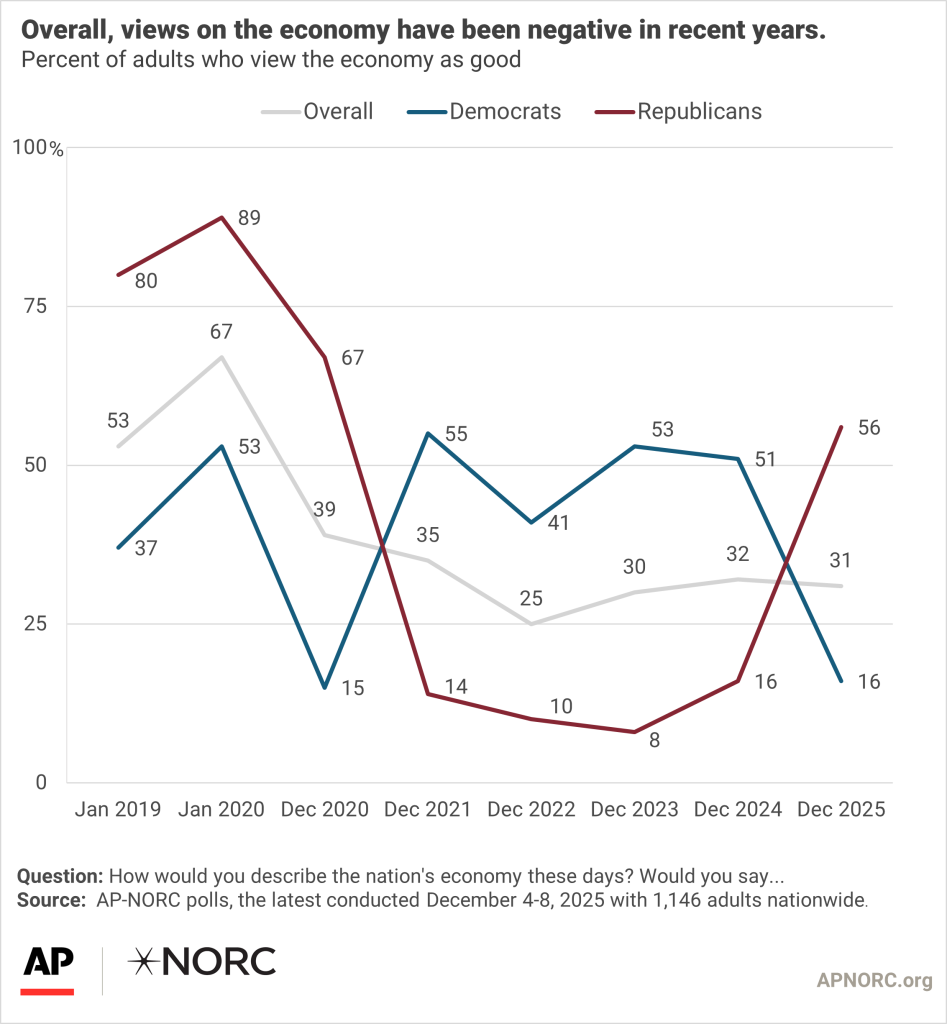

Two-thirds of the public describe the national economy as poor. This is in line with the public’s view in recent years. The last time the majority of the public described the economy as good in AP-NORC polls was January 2020.

Republicans have had more confidence in the economy since Trump took office earlier this year, though many Republicans currently report higher than usual prices for groceries (74%), electricity (59%), and holiday gifts (54%). Still, Democrats who are largely displeased with the economy are more likely than Republicans to say they are experiencing higher prices for groceries (94%), electricity (72%), and holiday gifts (72%).

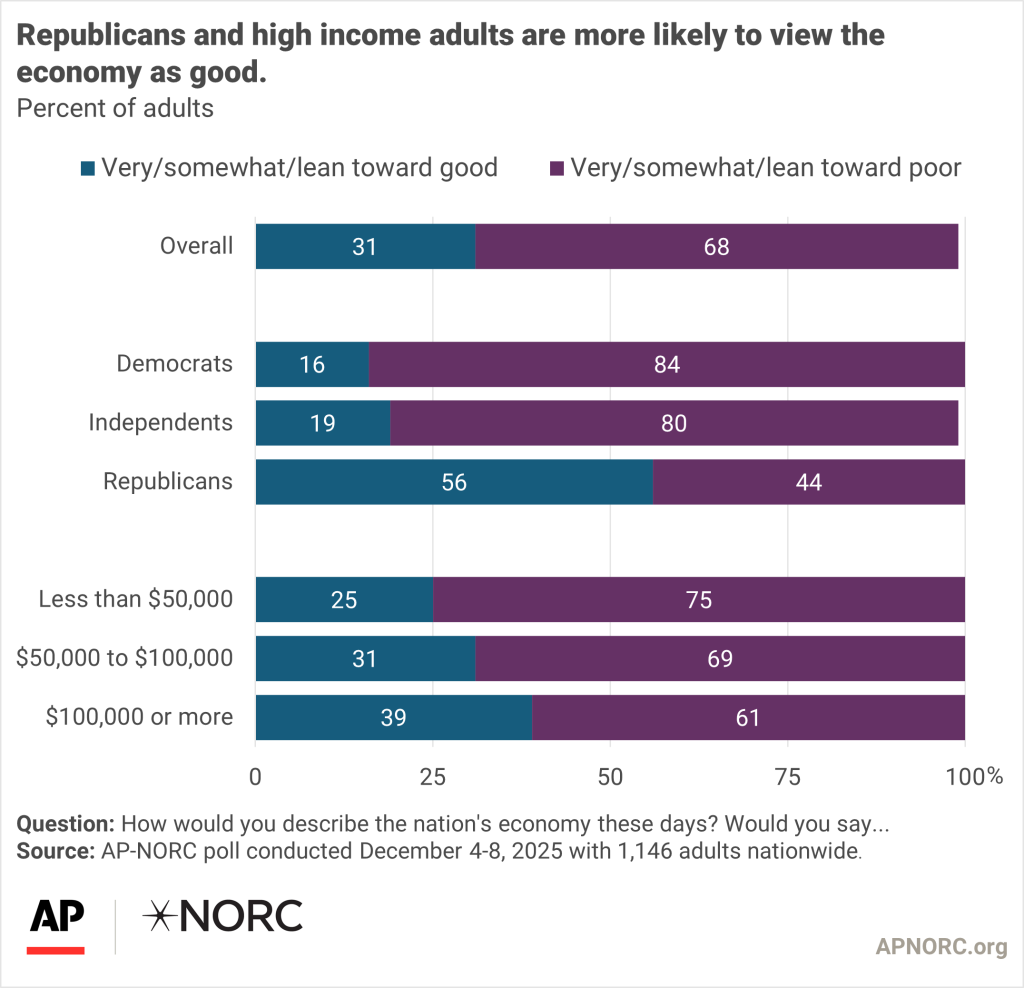

Overall, just 3 in 10 Americans feel the nation’s economy is in good shape. Republicans (56%) are more likely than both Democrats (16%) or independents (19%) to describe the economy as good.

Income level is also a significant factor in how individuals view the national economy. Households with incomes less than $50,000 a year are more likely to view the economy as poor, although even in more affluent households, a majority see the economy as in bad shape.

The nationwide poll was conducted December 4-8, 2025 using the AmeriSpeak® Panel, the probability-based panel of NORC at the University of Chicago. Online and telephone interviews using landlines and cell phones were conducted with 1,146 adults. The margin of sampling error is +/- 4.0 percentage points.

- Suggested Citation: AP-NORC Center for Public Affairs Research. (December 2025). “Affordability concerns are driving holiday belt-tightening” https://apnorc.org/projects/affordability-concerns-are-driving-holiday-belt-tightening/