Published: April 13, 2021

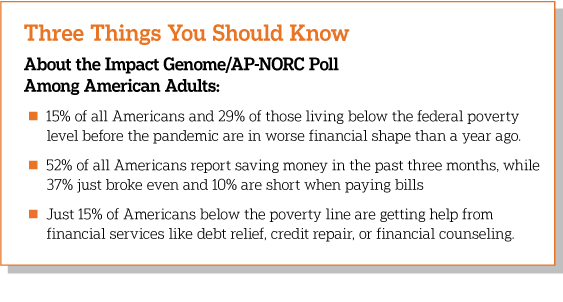

A year into the coronavirus pandemic, new data from an Impact Genome/AP-NORC Poll reveal that one in three Americans who were living below the federal poverty line before the pandemic report their personal finances are even worse off now. Further, their financial outlook is in jeopardy as well with 18% of individuals below the poverty line falling short on their bills by between $100 and $500 every month, and another 4% short more than $500 per month.

Despite this high financial need, just 15% of these Americans are getting help from financial services such as debt relief, credit repair, or financial counseling. When they do use these services, low income Americans are more likely to seek some of these services from government or a nonprofit, as opposed to private firms than those with higher income (32% vs just 4%). Affordability is often cited as a barrier among those lower income adults who do not use these services.

The financial picture looks very different for other Americans though. Fifty-five percent report their financial circumstances held steady over the course of the pandemic and 30% report being better off. More than half of all Americans have been able to save during the pandemic, including some who are putting away large sums. Nearly a quarter of Americans are saving more than $500 per month.

Still, 15% – approximately 38 million Americans – are worse off financially than a year ago, just before the pandemic lockdowns began. And many Americans find themselves on shaky ground, with only about half being able to save in the last three months. Long-term savings, like a 401(K) retirement plan, stock portfolio, or college savings account, play a critical role in economic mobility, but nearly a third of all Americans had not set one up before the start of the pandemic. Further, 11% of investment account contributors made an early withdrawal in order to pay for an immediate financial need.

Using an index of financial wellbeing developed by the Consumer Financial Protection Bureau (CFPB) to assess current financial health, the study reveals that 44% of Americans score in the highest category of financial wellbeing, and they are more likely to be older, white, and have more formal education.

Eight percent – or about 20 million Americans – have low financial wellbeing. These individuals express strong concerns that the money they have or will save won’t last, they can’t enjoy life because of challenges with money management, and they couldn’t handle a major unexpected expense. Similarly, a majority feel finances control their lives and that they rarely or never have money left over at the end of the month.

Other key findings include:

- Thirty percent of Americans report their financial situation has improved compared to the start of the pandemic 12 months ago, and another 55% say their finances haven’t changed. But, 15% – approximately 38 million Americans – are worse off financially.

- Those Americans who were suffering financially before the pandemic have been hit the hardest. Americans living below the FPL are more than twice as a likely as those with higher incomes to be in worse financial shape.

- Fifty-two percent of Americans report saving money in the past three months, while the other half have just broken even (37%) or find themselves unable to meet their financial obligations (10%). More than half of white Americans have been able to save money in recent months, compared to 39% of Black Americans. Black adults are more than twice as likely to report falling short on bill payments compared to white adults.

- Though 44% of Americans rate high in financial wellbeing, 48% rate as medium and 8% rate low. Those with low financial wellbeing face acute financial struggles. For example, 84% of those with low financial wellbeing report that their finances frequently control their life. Americans rating high in financial wellbeing are more likely to be white, over age 65, and have a college degree.

- Although some Americans are struggling to pay bills, only 23% are using financial counsellors, credit repair, or debt relief services. A quarter of Americans cite affordability as a reason they do not seek help from at least one of these services.

The nationwide Impact Genome/AP-NORC Poll was conducted with support from the Lincoln Financial Foundation between February 12 and March 3, 2021, with 2,374 adults age 18 and older using AmeriSpeak®, the probability-based panel of NORC at the University of Chicago. Interviews were conducted online and via telephone using landlines and cell phones. The margin of sampling error is +/- 2.9 percentage points.

Suggested Citation: AP-NORC Center for Public Affairs Research. (April, 2021). “Despite Signs of Economic Recovery, the Most Economically Vulnerable Americans Face Serious Financial Challenges” https://apnorc.org/projects/despite-signs-of-economic-recovery-the-most-economically-vulnerable-americans-face-serious-financial-challenges/