By Paul Wiseman and Hannah Fingerhut | The Associated Press

March 22, 2023

WASHINGTON (AP) — Only 10% of U.S. adults say they have high confidence in the nation’s banks and other financial institutions, a new poll finds. That’s down from the 22% who said they had high confidence in 2020.

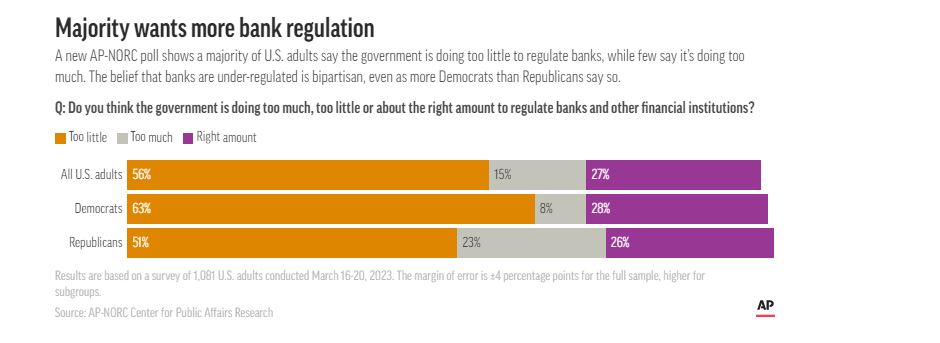

Following the collapse of Silicon Valley Bank this month, the poll from The Associated Press-NORC Center for Public Affairs Research also finds that a majority say the government is not doing enough to regulate the industry.

The underwhelming assessment of America’s banks and bank regulation comes after a series of shocks brought back disturbing memories of the 2008-2009 financial crisis.

Silicon Valley Bank, the nation’s 16th-biggest, failed March 10 after making risky bets in the bond market. Two days later, regulators closed New York-based Signature Bank, which had gotten involved in cryptocurrencies. Across the Atlantic Ocean, long-troubled Credit Suisse was acquired by rival UBS on Sunday in a shotgun marriage designed to restore confidence in global financial institutions.

In the United States, the tumult has raised questions among policymakers about 2018 legislation that rolled back strict regulations put in place after the financial crisis.

The poll suggests the U.S. public shares that concern: 56% say the government isn’t doing enough to regulate banks and other financial institutions, while 27% say it’s doing the right amount and 15% say it’s regulating too much. The worry about under-regulation is bipartisan: 63% of Democrats say current bank regulation is insufficient, as do 51% of Republicans.

U.S. Marine Corps veteran Philip Metscher, 53, a stay-at-home father of seven in Sacramento, California, said he has little faith in bankers or the government agencies that are supposed to regulate them.

“It’s like they have free rein to do whatever they want with money,” said Metscher, a Republican.

The poll finds that in addition to the 10% of Americans saying that they have high confidence in the nation’s banking institutions, 57% do have some confidence; 31% have hardly any.

Though confidence in banks and financial institutions has decreased even since the last time that question was asked on an AP-NORC poll in 2020, low confidence among Americans in their public institutions is nothing new — the General Social Survey, which has tracked trends in public opinion for decades, shows that confidence in institutions ranging from the financial industry to organized religion and from the news media to Congress has declined substantially since the 1970s. The new poll shows few Americans have high confidence in any branch of the U.S. government.

There’s been little change in the already glum assessment of the U.S. economy since a month ago, before the recent banking system turmoil, the poll shows. Only a quarter say national economic conditions are good; three quarters call them poor.

But 43% of Democrats call the economy good, versus just 7% of Republicans.

About half of U.S. adults describe their personal financial situations as good, a drop from last year when about 6 in 10 said that. About 6 in 10 Democrats and about half of Republicans give positive assessments of their current finances.

With a Democrat in the White House, Republicans are more likely than Democrats (36% versus 15%) to say their finances will get worse over the next year; 38% of Democrats say they expect their finances to improve, versus 22% of Republicans.

Overall, about half of U.S. adults expect U.S. economic conditions to deteriorate over the next year. Again, there’s a political divide: About three-quarters of Republicans but only a third of Democrats expect the national economy to worsen.

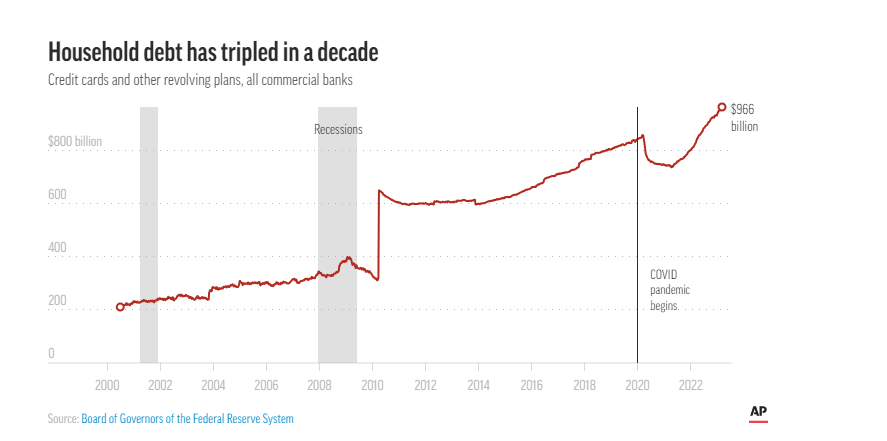

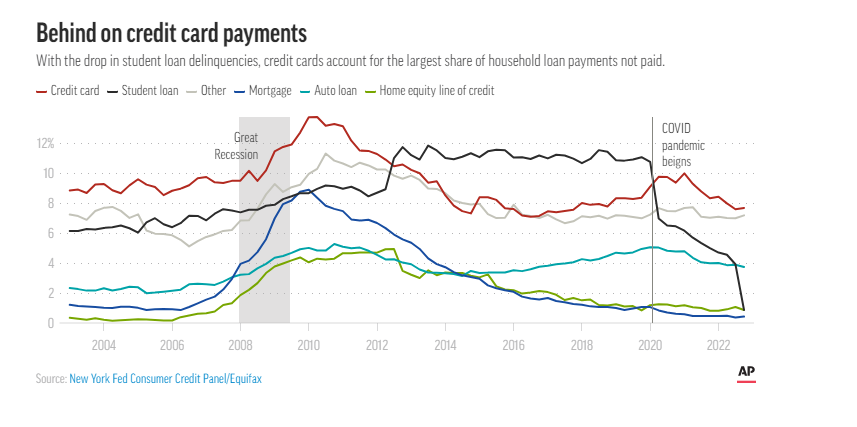

American households have been hit hard by inflation, which began to pick up in the spring of 2021. Adjusted for inflation, U.S. hourly wages have fallen for 23 straight months compared to a year earlier.

“You never know what’s going on. It’s paycheck to paycheck,” said Metscher in Sacramento. “I’m looking at food prices, gas prices. It reminds me of being a kid growing up’’ during the high-inflation 1970s.

Tyronda Springer, 28, a mother of two in Banks, Alabama, who works in a warehouse loading trucks, is struggling with the cost of living.

“I get paid every two weeks,” she said. “One of my checks goes straight to daycare. The rest is what I have to use to pay the bills. It’s just ridiculous.’’ But Springer, a Democrat, blames businesses, not President Joe Biden or the government, for ratcheting prices higher. “The government can only do so much,’’ she said.

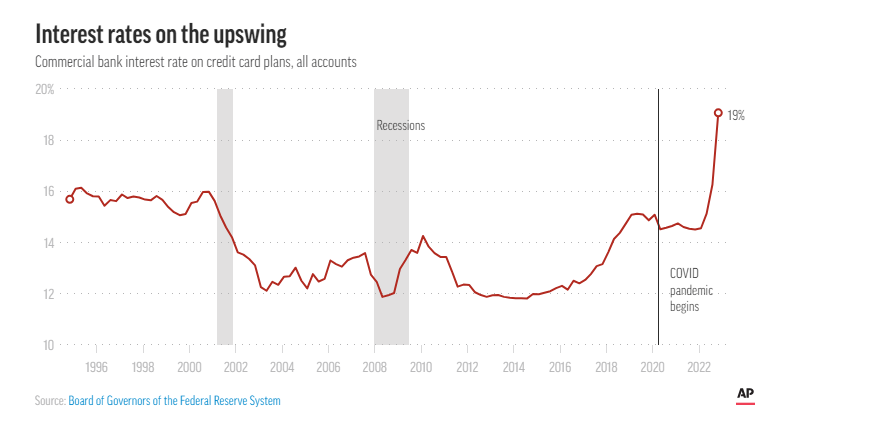

In response to surging consumer prices, the Federal Reserve has raised its benchmark interest rate nine times over the past year, including by a quarter-point on Wednesday. But the rate hikes are putting a strain on banks. In fact, Silicon Valley Bank ran into trouble as higher rates pushed down the value of its investments in bonds.

“It’s a financial house of cards,” said Bryan Martin, 49, of Westfield, New York, who works at a sewage treatment plant.

“The Fed is stuck,” said Martin, who does not identify with either political party but leans Republican. The central bank has to raise interest rates to fight inflation, but higher rates are hurting the financial system. “These banks,’’ he said, “are starting to fail.’’

Darlene Brady, 72, a retired nurse’s aide in Butler, Pennsylvania, has limited confidence in banks. Still, Brady, a Democrat, is not worried about her own bank savings, thanks to federal deposit insurance that covers up to $250,000.

“I’m way below that,” she said. ___

The poll of 1,081 adults was conducted Mar. 16-20 using a sample drawn from NORC’s probability-based AmeriSpeak Panel, which is designed to be representative of the U.S. population. The margin of sampling error for all respondents is plus or minus 4.0 percentage points.