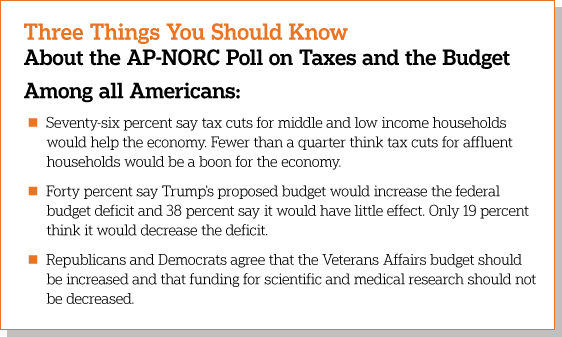

Few Americans believe across the board tax cuts will help the economy or that President Donald Trump’s proposed budget will reduce the federal deficit. In the latest poll conducted by The Associated Press-NORC Center for Public Affairs Research, there is bipartisan agreement that middle class households have too high a tax burden and that the wealthy do not pay their fair share in taxes.

About three-quarters of Americans say tax cuts for low and middle income people would benefit the economy and more than half agree that a corporate tax cut would be helpful. But less than a quarter of the public think tax cuts for affluent households would be a boon for the economy.

With the exception of additional spending for Veterans Affairs and reductions in funds for scientific and medical research, there is substantial partisan disagreement over Trump’s proposed budget. For example, Republicans support and Democrats oppose decreased spending on public broadcasting and the arts. Similarly, Republicans support and Democrats oppose increases in the military and defense budget.

The nationwide poll was conducted March 23-27, 2017, using the AmeriSpeak® Panel, the probability-based panel of NORC at the University of Chicago. Online and telephone interviews using landlines and cell phones were conducted with 1,110 adults. The margin of sampling error is +/- 4.0 percentage points.