With businesses shuttered across the country in response to the coronavirus outbreak, Americans are taking an increasingly negative view of the U.S. economy as many of them start to feel the effects of economic turmoil. Many report lost jobs or income and trouble paying bills. Yet, they also remain fairly optimistic about their personal finances over the next year. And while they remain supportive of social distancing measures enacted by state and local governments, they also want the government to provide more financial assistance to individual Americans and small businesses.

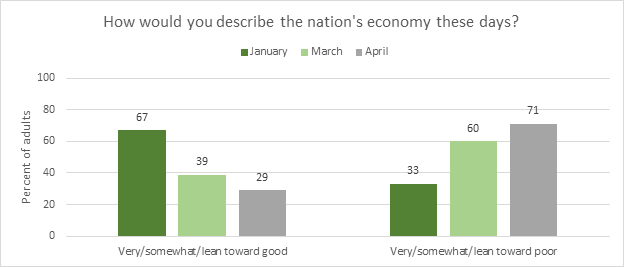

The public’s view of the U.S. economy continues to decline in the wake of the coronavirus outbreak. Since January, when 67% described the national economy as good, the share who say the economy is doing well has declined to just 29%.

Question: How would you describe the nation’s economy these days? Would you say…Source: AP-NORC Polls conducted January 16-21, 2020 with 1,353 adults, March 26-29, 2020 with 1,057 adults, and April 16-20, 2020, with 1,057 adults nationwide.

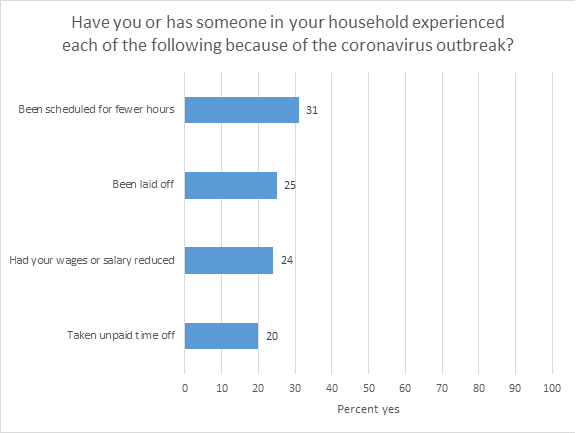

Many Americans are starting to feel the effects of the economic downturn and report facing economic pressures as a result of the coronavirus outbreak. Thirty-one percent say they or someone in their household has been scheduled for fewer hours at work, 24% had wages or salary reduced, and 20% have taken unpaid time off. A quarter of Americans say they or someone in their household have been laid off because of the coronavirus outbreak.

Question: Have you or has someone in your household experienced each of the following because of the coronavirus outbreak? Source: AP-NORC Poll conducted April 16-20, 2020, with 1,057 adults nationwide.

Among those who say they or someone in their household has been laid off, 20% do not expect that person to get their job back, and 78% think there is a chance of going back.

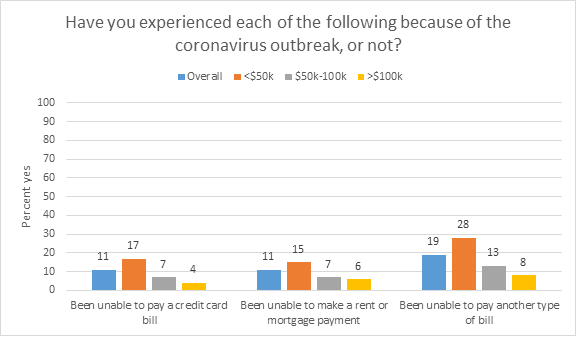

With these challenges with income, some Americans report having trouble paying bills. Eleven percent are falling behind on a credit card bill or have been unable to make a rent or mortgage payment. Nineteen percent have been unable to pay another type of bill.

Overall, those with lower incomes are more likely to be falling behind. Thirty-one percent of those with a household income under $50,000 a year have either been unable to pay rent, make a credit card payment, or pay another type of bill due to the coronavirus pandemic compared to 16% of those making between $50,000 and $100,000 and 10% of those making more than $100,000.

Question: Have you experienced each of the following because of the coronavirus outbreak, or not? Source: AP-NORC Poll conducted April 16-20, 2020, with 1,057 adults nationwide.

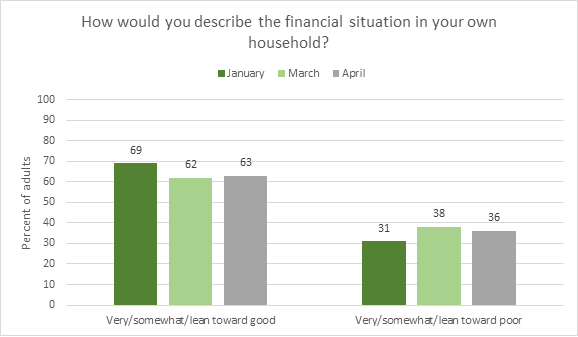

However, Americans’ evaluations of their personal economic situation overall have held steady over the last few months. Nearly two-thirds still say their household’s financial situation is good, just slightly fewer than in January before the coronavirus outbreak began in the United States. They also remain fairly optimistic about changes over the next year: 36% expect their personal finances to get better and 46% expect them to stay the same. Just 17% expect them to get worse. These rates have not changed much since March.

Question: And how would you describe the financial situation in your household these days? Source: AP-NORC Polls conducted January 16-21, 2020 with 1,353 adults, March 26-29, 2020 with 1,057 adults, and April 16-20, 2020, with 1,057 adults nationwide.

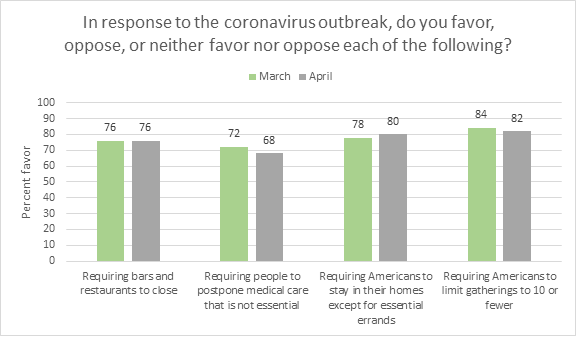

Despite the financial impacts of the virus, Americans remain broadly supportive of social distancing measures implemented by their state and local governments. Few Americans say restrictions in place have gone too far (12%). Most (61%) say they are about right, and 26% say they do not go far enough.

Question: In response to the coronavirus outbreak, do you favor, or oppose, or neither favor nor oppose each of the following?Source: AP-NORC Poll conducted April 16-20, 2020, with 1,057 adults nationwide.

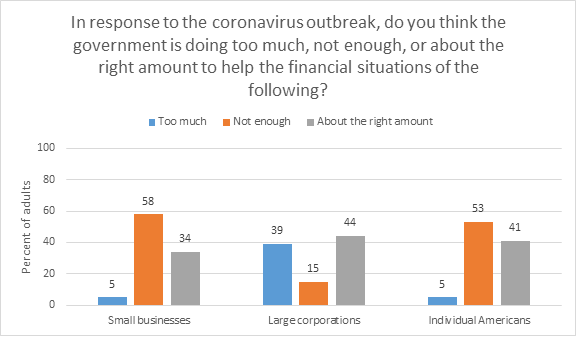

Many Americans would like the government to do more to help the economy. More than half says the government is not doing enough to help the financial situations of individual Americans or small businesses. They are more likely to say the government is doing enough or too much to help large corporations.

Question: In response to the coronavirus outbreak, do you think the government is doing too much, not enough, or about the right amount to help the financial situations of the following?Source: AP-NORC Poll conducted April 16-20, 2020, with 1,057 adults nationwide.

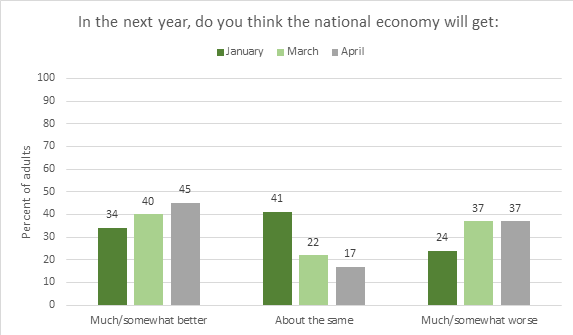

Asked to look ahead to the next year, more Americans are optimistic that the national economy will get better than think it will get worse. In January, the public was most likely to say the economy would stay the same over the next year.

Question: [The national economy] In the next year, do you think each of the following will get better, get worse, or stay about the same?Source: AP-NORC Polls conducted January 16-21, 2020 with 1,353 adults, March 26-29, 2020 with 1,057 adults, and April 16-20, 2020, with 1,057 adults nationwide.

Overall, slightly more than half (52%) of Americans approve of how President Trump is handling the economy. Approval of his handling of the economy compares favorably to how they think he is handling other issues like foreign policy or health care – 39% approve of each.

The nationwide poll was conducted April 16-20, 2020 using the AmeriSpeak® Panel, the probability-based panel of NORC at the University of Chicago. Online and telephone interviews using landlines and cell phones were conducted with 1,057 adults. The margin of sampling error is plus or minus 4.0 percentage points.