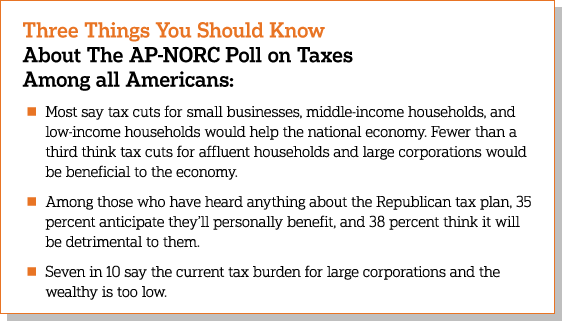

Most Americans think tax cuts for the middle class, low-income Americans, and small businesses would help the national economy but expect that the tax plan proposed by President Trump and congressional Republicans would not be beneficial to these groups. Instead, most expect the proposed tax changes to benefit large corporations and wealthy Americans with little advantage to the national economy.

According to the latest AP-NORC poll, most Americans disapprove of how Trump is handling taxes. Yet most also admit to knowing little or nothing about the tax plan proposed by the president and congressional Republicans. Trump and Republican leaders in Congress released an outline of their plan in September. The legislation is still being drafted in Congress.

Two-thirds of Americans say taxes are an extremely or very important issue to them personally. But, while 30 percent say they trust the Democrats to deal with the issue and 24 percent say they trust the Republicans, even more, 35 percent, do not have any confidence in either party to take care of taxes. Eleven percent have faith in both parties to deal with the issue.

About 7 in 10 say wealthy households and large corporations pay too little in taxes, while more than half of Americans think they personally pay too much, along with middle-income households and small businesses.

The nationwide poll was conducted by The Associated Press-NORC Center for Public Affairs Research from October 12-16, 2017 using the AmeriSpeak® Omnibus, a monthly multi-client survey using NORC at the University of Chicago’s probability-based panel. Online and telephone interviews using landlines and cell phones were conducted with 1,054 adults. The margin of sampling error is +/- 4.0 percentage points.