Most Americans say their financial situation is good, but fewer expect things to improve over the next year. While most say their income has kept up with their expenses, 25% say it has fallen behind. While there has been some improvement in the public’s assessment of their financial circumstances since the beginning of the year, there are still some signs of financial insecurity. Few have much confidence in their ability to retire or to pay an unexpected $1,000 bill.

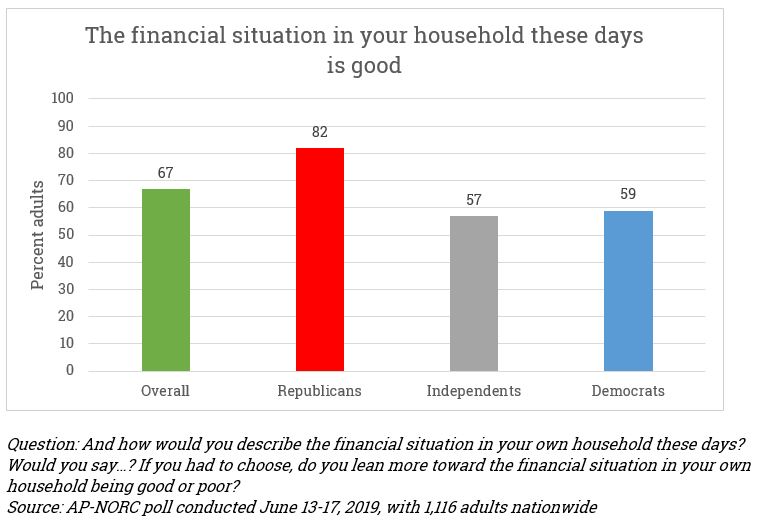

Sixty-seven percent describe their household’s financial situation as good, and 32% say it is poor. Thirty-seven percent expect their personal finances to improve over the next year, and 48% think their finances will remain the same. Only 13% anticipate a decline, down from 21% who said that in an AP-NORC survey conducted in January. Of those who expect their finances to stay the same, 71% say their household finances are good, and 29% say they are poor.

In another indication of improved confidence in the economy, 41% say it is a good time to buy a home, up from 34% in January. There is less confidence in Wall Street compared to real estate. Thirty-three percent say it is a good time to invest in the stock market; in January, 28% said it was a good time.

When it comes to views on household financial situations, differences emerge by party. Democrats and independents are less likely to describe their financial situation as good than are Republicans, when controlling for income and other demographic differences.

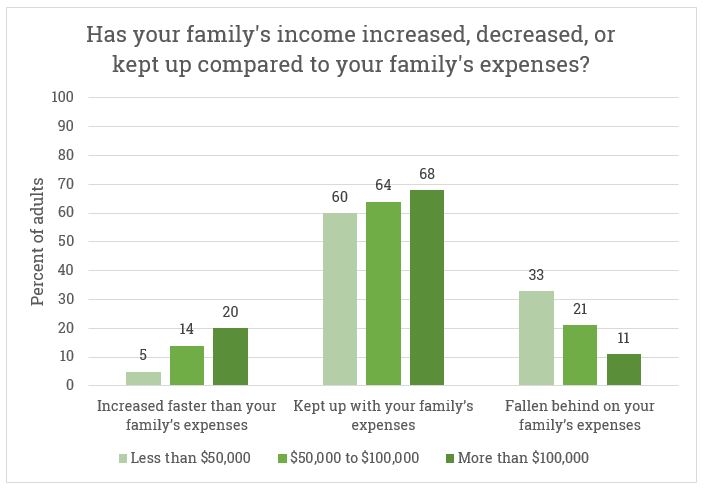

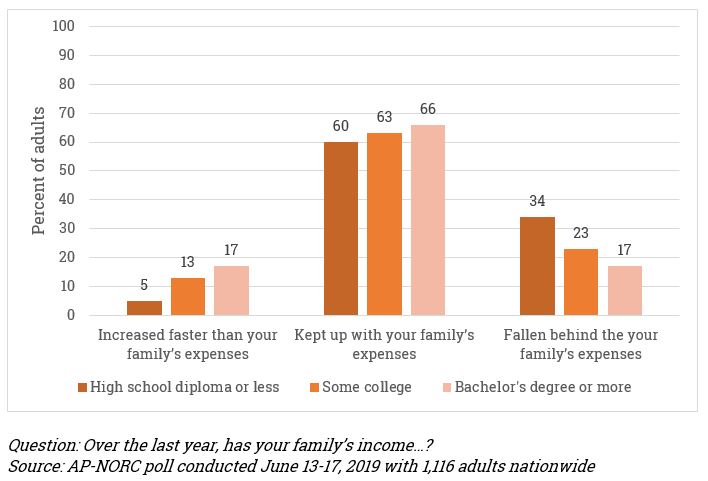

Sixty-three percent say their family’s income has kept up with their expenses, and 11% say their income has increased faster than expenses. But 25% say their income has lagged behind their day-to-day living expenses. Better-educated and more affluent Americans are more likely than others to say they are getting ahead.

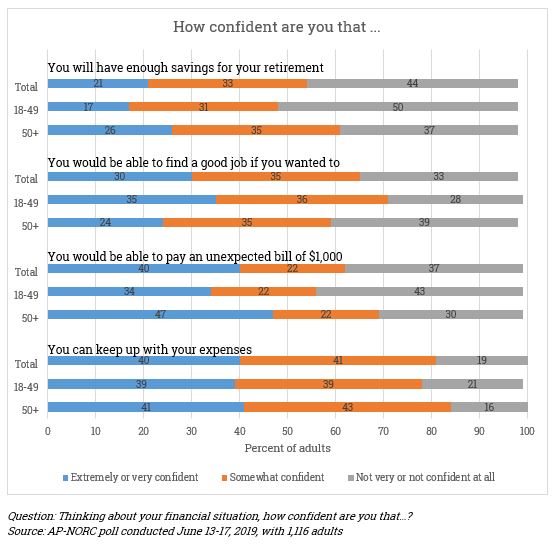

Forty percent say they can keep up with their expenses and would be able to handle an unexpected bill of $1,000, while 30% believe they could find a good job, and only 21% think they will save enough for retirement. These numbers remain unchanged since January of this year.

Americans who are younger than 50 are more likely than older adults to say that they would be able to find a good job if needed. Older Americans, on the other hand, are more confident in their ability to cover an unexpected bill than are younger Americans. Those with incomes above $50,000 are more likely to say they would be able to pay an unexpected bill, keep up with their expenses, save for retirement, and find a good job.

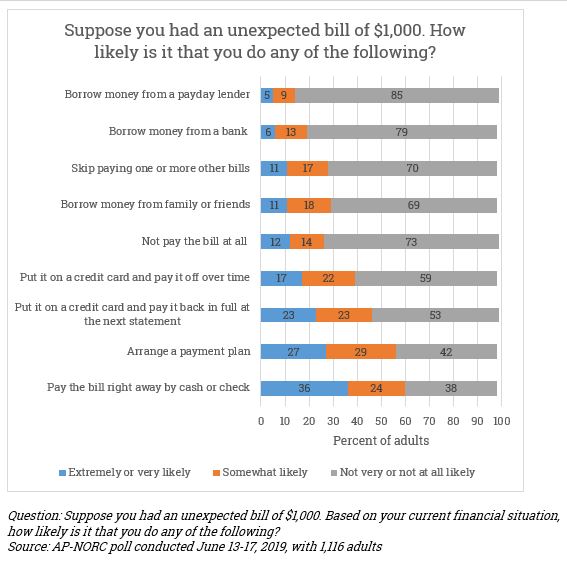

While most Americans say they would be able to pay an unexpected bill right away, those with incomes under $50,000 are more likely to say they would need to borrow money than are wealthier people. Those making more than $50,000 are more likely to pay the bill immediately. Twelve percent say it is very likely they would not pay the bill at all. These trends remain unchanged since April of 2016.

The nationwide poll was conducted June 13-17, 2019, using the AmeriSpeak® Panel, the probability-based panel of NORC at the University of Chicago. Online and telephone interviews using landlines and cell phones were conducted with 1,116 adults. The margin of sampling error is plus or minus 4.0 percentage points.