June 11, 2024

Public support for student loan forgiveness varies slightly based on the reasons for the relief, and there are significant differences in attitudes related to people’s partisanship and experience with student debt, according to a new UChicago Harris/AP-NORC Poll.

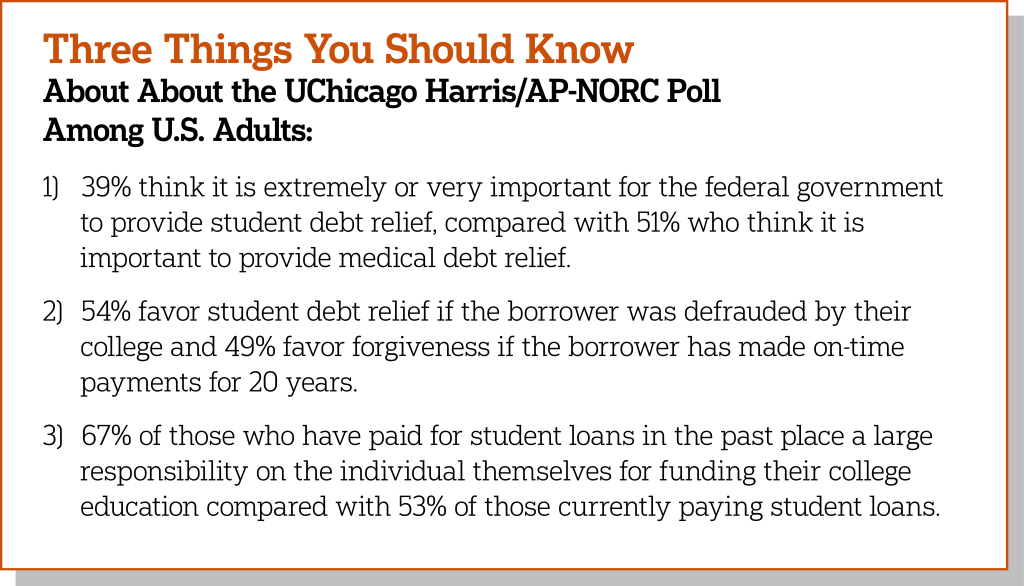

Fewer adults say it is extremely or very important for the federal government to forgive student loan debt (39%) than medical debt (51%). Less than a third of the public approve of how student loan debt is being handled by President Biden (30%), the Democratic Party (28%), the Republican Party (21%), or the Supreme Court (15%).

In April, the Biden-Harris administration announced its latest iteration of student debt forgiveness policy through the Higher Education Act. Existing programs offer forgiveness for borrowers working in public service for 10 years, those who were defrauded by colleges they attended, and borrowers paying for 20 to 25 years on repayment plans. The new policy would include debt relief for borrowers who now owe more than originally borrowed due to accruing interest, who enrolled in low-financial-value programs, or face financial hardship that would prevent them from repaying student loans.

The survey finds the public is more likely to support than oppose forgiveness of some or all of a student loan if the borrower was defrauded or misled by their school, (54% vs. 18%), has made on-time payments for 20 years (49% vs. 23%), has accrued more interest than originally borrowed (44% vs. 26%), went to an institution that left them with a large amount of debt compared to their income (41% vs. 29%), or is experiencing financial hardship (41% vs. 28%). Sixty-five percent of the public favor student debt forgiveness in at least one of the circumstances asked on the survey.

Experience with student debt relates to attitudes toward forgiveness. Those who are currently paying student loans (54%) are more likely than respondents who have paid off loans (31%) or have no experience with student debt (34%) to consider student debt relief from the federal government important.

There are also significant partisan differences. Fifty-eight percent of Democrats find student loan forgiveness important, compared with 44% of independents and just 15% of Republicans.

Democrats are also more likely than independents or Republicans to favor debt forgiveness under the circumstances outlined in the Biden-Harris administration plan, such as eliminating debt due to runaway interest (62% vs. 37% and 27%), debt forgiveness for borrowers who entered repayment over 20 years ago (65% vs. 44% and 34%), and relief for borrowers who went to institutions that left them with large debt to income ratios (59% vs. 38% and 22%).

Among both Democrats and Republicans, views on student debt relief vary based on education but having a college degree has differing effects among Democrats and Republicans. Democrats with a college degree are more likely than those without a college degree to favor student loan forgiveness if the borrower is experiencing financial hardship, (68% vs. 53%), went to an institution that left them with a large debt to income ratio (66% vs. 53%), or have accrued more interest than the amount originally borrowed (74% vs. 54%).

In contrast, Republicans with a college degree are more likely than Republicans without a college degree to oppose student loan forgiveness if the borrower is experiencing financial hardship, (66% vs. 45%), went to an institution that left them with a large debt to income ratio (64% vs. 44%), or have accrued more interest than the amount originally borrowed (55% vs. 39%).

In contrast, Republicans with a college degree are more likely than Republicans without a college degree to oppose student loan forgiveness if the borrower is experiencing financial hardship, (66% vs. 45%), went to an institution that left them with a large debt to income ratio (64% vs. 44%), or have accrued more interest than the amount originally borrowed (55% vs. 39%).

The nationwide poll was conducted by the University of Chicago Harris School of Public Policy and The Associated Press-NORC Center for Public Affairs Research from May 16 to May 21, 2024, using AmeriSpeak®, the probability-based panel of NORC at the University of Chicago. Online and telephone interviews using landlines and cell phones were conducted with 1,309 adults. The margin of sampling error is +/-3.7 percentage points.

- Suggested Citation: AP-NORC Center for Public Affairs Research. (June 2024). “Views toward student loan relief are tied to partisanship and experience with debt” https://apnorc.org/projects/views-toward-student-loan-relief-are-tied-to-partisanship-and-experience-with-debt/